- Written By Team DWS

- News

- August 16, 2025

European 50 Countries' Tariff List on India's Gems and Jewelry Industry – August 2025

Introduction: The Pulse of Global Jewelry Trade

India’s gems and jewelry industry, often described as the “crown jewel” of its export sector, has been a vital part of the nation's economy for decades. In August 2025, the entire ecosystem faced seismic shifts due to unprecedented changes in global trade dynamics—led primarily by drastic tariff impositions by the world’s major jewelry-importing countries. The effect is acutely felt across the 50 countries in Europe and beyond, which collectively form the backbone of the global jewelry trade.

This blog post explores, with detail and fresh context, how changing tariffs in these top 50 countries are impacting both DWS Jewellery (one of India’s prominent jewelers and exporters) and the broader Indian industry. We start with context on the industry, unravel the global tariff landscape as of August 2025, and then dive into market-wise impacts, challenges, adaptation strategies, and future prospects.

________________________________________

I. India’s Gems & Jewelry Industry: A Global Powerhouse at Crossroads

India is the world’s largest diamond processing center, a leading gold jewelry manufacturer, and a significant exporter of both contemporary and traditional ornaments. Its $40-billion export industry sustains millions of livelihoods, especially in hubs like Surat, Mumbai, and Jaipur, and supplies roughly 14 of every 15 cut diamonds globally. For firms like DWS Jewellery, European and US markets have long accounted for a major share of revenues, reputation, and strategic growth.

Yet, in mid-2025, the landscape changed dramatically.

________________________________________

II. The 2025 Tariff Shock: What Happened?

A. The US Tariff Earthquake

On August 7, 2025, the United States—India’s single largest jewelry export destination—implemented a sweeping, blanket 50% tariff on Indian gems and jewelry, up from a prior 25%. This action was widely described as “doomsday” for Indian exporters, with US-bound orders rapidly drying up, and manufacturers scrambling to reroute shipments through lower-tariff countries like UAE and Mexico.

B. European and Global Ripple Effects

Simultaneously, the 50 top jewelry-importing countries—from the US, UK, and Switzerland to UAE, China, Germany, and France—have either imposed or are considering stricter tariff regimes, reflecting a global surge in protectionism. Although no other single market matched the US’s dramatic 50% rate, several have implemented new or increased tariffs ranging from 10–30% (see full list and discussion below).

________________________________________

III. The 50 Key Jewelry Importing Countries: A Market-wise Overview

Below is a summary of the 50 largest jewelry importers as of 2025, with discussion on their unique market characteristics, their approach to tariffs, and their overall impact on India’s export prospects.

| Rank | Country | Notable Market Characteristics |

| 1 | United States | Vast, luxury-focused, trend-setting, now 50% tariff |

| 2 | China | Surging middle class, luxury demand, stricter post-2025 |

| 3 | Hong Kong SAR | Asian jewelry hub, re-exporter, flexible tariffs |

| 4 | Switzerland | Watch/luxury sector, moderate tariffs, gold/diamond import |

| 5 | UAE | Gold hub, European-Asia trade, 10% duty (lower than US) |

| 6 | India | Major exporter & consumer |

| 7 | UK | Luxury & vintage, 15–20% tariffs post-Brexit |

| 8 | Singapore | Retail/tourism, flexible tariffs, re-exporter |

| 9 | France | Fashion hub, 17–20% duty on non-EU jewelry |

| 10 | Japan | High-end, quality driven, 10–15% standard tariffs |

| ... | ... | ... (See original detailed source for full 50-country list) |

Many of these tariff rates have changed or are under review as of August 2025 due to ongoing global trade realignments. The US stands out as the most extreme, with a blanket 50% duty, while EU nations now commonly impose 15–25% on many categories of non-EU jewelry imports, including those from India.

________________________________________

IV. How Are These Tariffs Impacting India's (and DWS's) Exports?

A. Immediate Impact

- Steep Price Hikes: Exporters face sharply higher import duties, making Indian jewelry significantly less competitive compared to products from countries with lower tariffs (e.g., UAE at 10%, Mexico at 25%, Vietnam at 20%).

- Order Cancellations: Buyers are backing out of deals, citing the high cost and increased supply inertia from major Indian jewelry exporters.newindianexpress+2

- Shift to Alternate Hubs: Indian companies, including DWS, are considering setting up assembly units in lower-tariff nations, such as UAE, Oman, or Mexico, to reroute their goods and maintain market access legally.

B. Broader Economic Fallout

- Livelihoods At Risk: Millions employed directly or indirectly by the sector are at risk of job loss or wage cuts, as the volume of US and European orders declines.

- Pressure on Artisans: Regional clusters like Surat (diamonds), Jaipur (colored stones), and Mumbai (fine jewelry) are experiencing slowdowns, wage stagnation, and even factory shutdowns.

C. Market Diversification

The Indian government and industry bodies (e.g., GJEPC) have announced plans to aggressively target the other 50 major jewelry-importing markets, which now serve both as alternatives to the US and new growth centers. New trade agreements and tariff negotiation efforts focus on Europe, West Asia, Africa, and Southeast Asia.

________________________________________

V. Country-Specific Tariff Developments in August 2025

Below is a market-wise snapshot of key tariff rates relevant to Indian gems and jewelry as of August 2025. (Note: Actual rates may vary by product category and are subject to policy updates.)

| Country | Jewelry Import Tariff (Approximate) | Notes |

| USA | 50% | Blanket; effective August 27, 2025 |

| UAE | 10–12% | Remains low; popular re-routing destination for Indian exporters |

| France | 17–20% | Applies to non-EU imports; higher for certain finished products |

| Germany | 15–20% | Applies broadly to jewelry from non-EU countries |

| Italy | 15–18% | Moderately high for gold, silver, and gems |

| Switzerland | 10–15% | Lower base rate; higher for watches/luxury items |

| UK | 15–20% | Post-Brexit regime, matches EU rates for many items |

| China | 20–25% | Higher for luxury categories |

| Japan | 10–15% | Standard MFN tariff |

| Hong Kong | 0–3% | Remains minimal; major trading and re-export hub |

| Turkey | 19–20% | Comparable to Vietnam, competitive for gold jewelry |

| Vietnam | 20% | Alternative destination for manufacturers |

| Mexico | 25% | Considered for rerouting Indian goods to US |

| Others (avg.) | 10–20% | Varies; most have raised rates in recent years |

Note: EU rates tend to be harmonized or within narrow ranges but can vary by product (e.g., precious stones, studded gold, watches, silver jewelry, etc.). Some exemptions exist for specific developing countries or under trade agreements, but India typically faces “most favored nation” rates since it lacks an FTA with the EU as of 2025.

________________________________________

VI. The Competitive Disadvantage: Why These Tariffs Matter

A. Loss of Price Advantage

With a 50% tariff, an Indian gold necklace priced at $2,000 now lands in the US at $3,000+, while similar pieces from UAE or Vietnam enter at just $2,200–2,400. Such margins are impossible for even the most efficient Indian factories to absorb, leading to a sharp loss in competitiveness.

B. Trade Diversion, Transparency, and Risks

Efforts to reroute Indian jewelry through lower-tariff countries are underway but subject to scrutiny, additional costs, and potential regulatory hurdles (e.g., US CBP audits on country of origin). Not all manufacturers have the capacity, scale, or transparency to legally set up overseas units.

C. Threat to India’s Export Dominance

India’s global share in diamond processing, colored stones, and gold jewelry exports will likely fall as buyers and retailers in Europe opt for lower-tariff supply chains from Turkey, China, UAE, or Vietnam.

________________________________________

VII. How DWS Jewellery and Peers Are Responding

A. Rerouting and Strategic Partnerships

DWS and other top exporters are investigating joint ventures, contract manufacturing, and franchise models in the Middle East, Turkey, and Mexico to maintain global market share and avoid punitive tariffs.

B. Supply Chain Innovations

- Automation and digitalization of operations.

- Investing in sustainability and ethical sourcing certifications, as buyers in Europe increasingly demand traceability and conflict-free guarantees.

- Diversification towards new jewelry categories (e.g., platinum, lab-grown diamonds) that face less severe tariff penalties or are growing in demand.

C. Market Recalibration

- Immediate pivot towards Asia, Africa, and Latin America as alternative growth geographies.

- Aggressive participation in global trade fairs, regional marketing campaigns, and direct-to-consumer initiatives online.

________________________________________

VIII. The Way Forward: Prospects, Hope, and Challenges

A. Short Term: Painful Adjustment

The next few quarters will be marked by layoffs, margin pressure, and rationalization across the value chain. Industry bodies continue to lobby for government relief in the form of duty drawbacks, interest deferment, or targeted export incentives for affected sectors.

B. Medium to Long Term: Global Realignment

Despite immediate headwinds, India’s jewelry sector—catalyzed by creativity, resilience, and adaptability—is expected to leverage its scale, artisan base, and market understanding to reclaim growth. Successful partnerships and legal offshore rerouting of final assembly may neutralize some disadvantages.

C. Policy Support and Diplomacy

A concerted push by Indian diplomats for preferential market access through new FTAs, renewed engagement with the EU, and new-age digital trade pacts is critical. The government’s plan to aggressively target 50 alternative countries is a step in the right direction.

________________________________________

IX. Concluding Thoughts: DWS Jewellery as a Bellwether for Industry Evolution

The jewelry import landscape in Europe and the wider world is experiencing its most profound transformation in decades. For DWS Jewellery—and for India as a whole—success in 2025 and beyond will depend not only on craftsmanship and cost, but on agility in business strategy, transparency in supply chains, and the ability to forge alliances across continents.

The road ahead is undeniably challenging, yet full of opportunity for those ready to adapt, innovate, and champion both tradition and change.

-dws638909075403000551.jpg)

________________________________________

Note

For country-specific, product-wise tariff details, exporters should reference official market intelligence reports, tariff databases, and work closely with logistics and customs consultants as the environment remains highly dynamic and sensitive to ongoing negotiations and policy changes.

Popular on Blogs

Black Tourmaline: Meaning, Healing Properties, Fascinating Facts, Powerful Attributes, Versatile Uses, and Beyond

September 05, 2023 / BY Team DWS

Black Tourmaline, also known as Schorl, is a highly revered crystal with incredible metaphysical properties. It derives its name from the Dutch word "turamali," meaning "stone with ..

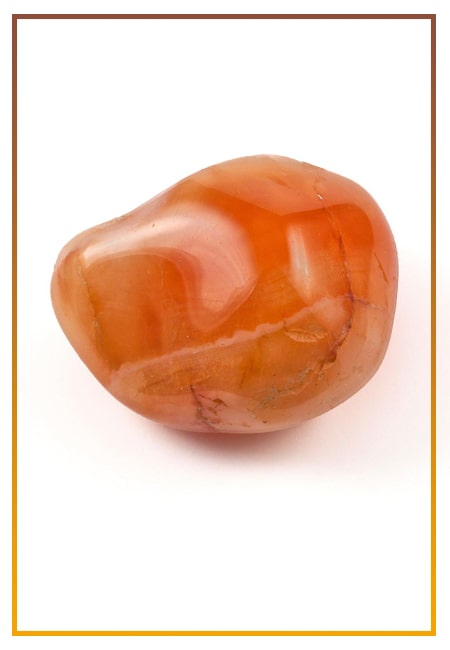

Carnelian Stone: Meaning, Healing Properties, Power, Facts, Color, Uses and More

December 26, 2023 / BY Team DWS

Carnelian is a vibrant and captivating gemstone that holds a plethora of meanings, healing properties, and powers. Its warm and fiery energy makes it a popular choice among crystal ..

Citrine: Exploring its Meaning, Healing Properties, Fascinating Facts, Powers, Versatile Uses, and Much More

November 18, 2023 / BY Team DWS

Citrine, with its warm golden hues, has captured the attention and imagination of people for centuries. This beautiful gemstone, commonly associated with wealth and prosperity, hol ..

Black Onyx: Unveiling the Meaning, Healing Properties, Fascinating Facts, Powerful Attributes, Versatile Uses, and Beyond

July 25, 2023 / BY Team DWS

Black Onyx, a striking gemstone admired for its deep black hue and elegant appearance, has captivated people for centuries. In this comprehensive guide, we will delve into the mean ..

Unveiling the Mysteries of Turquoise Stone: Exploring its Meaning, Healing Properties, Power, Facts, Color, Uses, and More

December 05, 2023 / BY Team DWS

Turquoise, with its captivating blue-green hue, has been adorning jewelry and artifacts for centuries. This striking stone has a rich history, rich symbolism, and a plethora of int ..

The History Behind The Popularity of Red Agate

December 23, 2022 / BY Team DWS

An Agate is a type of magma rock that takes many years till it is washed out naturally into the water. And that is the reason this stone has elements of water. This beautiful stone ..

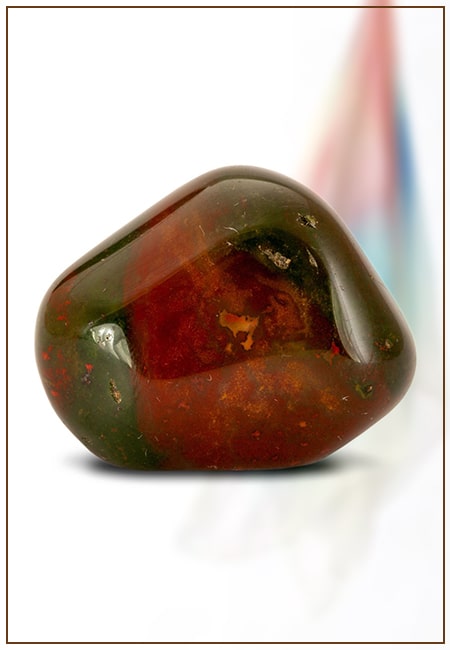

Bloodstone: Unveiling the Meaning, Healing Properties, Facts, Powers, Uses, and More

August 21, 2023 / BY Team DWS

Bloodstone, with its captivating deep green color with specks of red, is a mesmerizing gemstone that has fascinated civilizations for centuries. It possesses unique healing propert ..

Plan a Perfect Valentine's Week with Our Valentine Week List 2025

January 22, 2024 / BY Team DWS

Valentine's Day is undoubtedly the most romantic day of the year, but we believe that one day is just not enough to express your love and make your partner feel special. That's why ..